Hello, Seattle homeowners! If you’re on the exciting journey of selling your home in our wonderful city, understanding the home appraisal process is crucial. In this blog post, we’ll break down the appraisal process in simple terms, so you can confidently navigate this important step in selling your home.

What is a Home Appraisal?

A home appraisal is an independent evaluation of your property’s value. It’s conducted by a professional appraiser to determine the fair market value of your home. Appraisals are an essential part of the home selling process, as they help establish a fair price for your property.

Why Do You Need an Appraisal?

Appraisals are important for several reasons:

Setting the Right Price: An accurate appraisal helps you set a reasonable and competitive price for your home.

Lender Requirements: If your buyer is obtaining a mortgage, their lender will require an appraisal to ensure the property’s value matches the loan amount.

Negotiation Tool: An appraisal can be used as a negotiation tool. It provides an objective valuation that both buyers and sellers can refer to.

The Appraisal Process

Let’s dive into the appraisal process and what you can expect:

1. Selection of the Appraiser

Your lender, or in some cases the buyer, will select a licensed appraiser. It’s essential to work with a reputable appraiser who is knowledgeable about the Seattle real estate market.

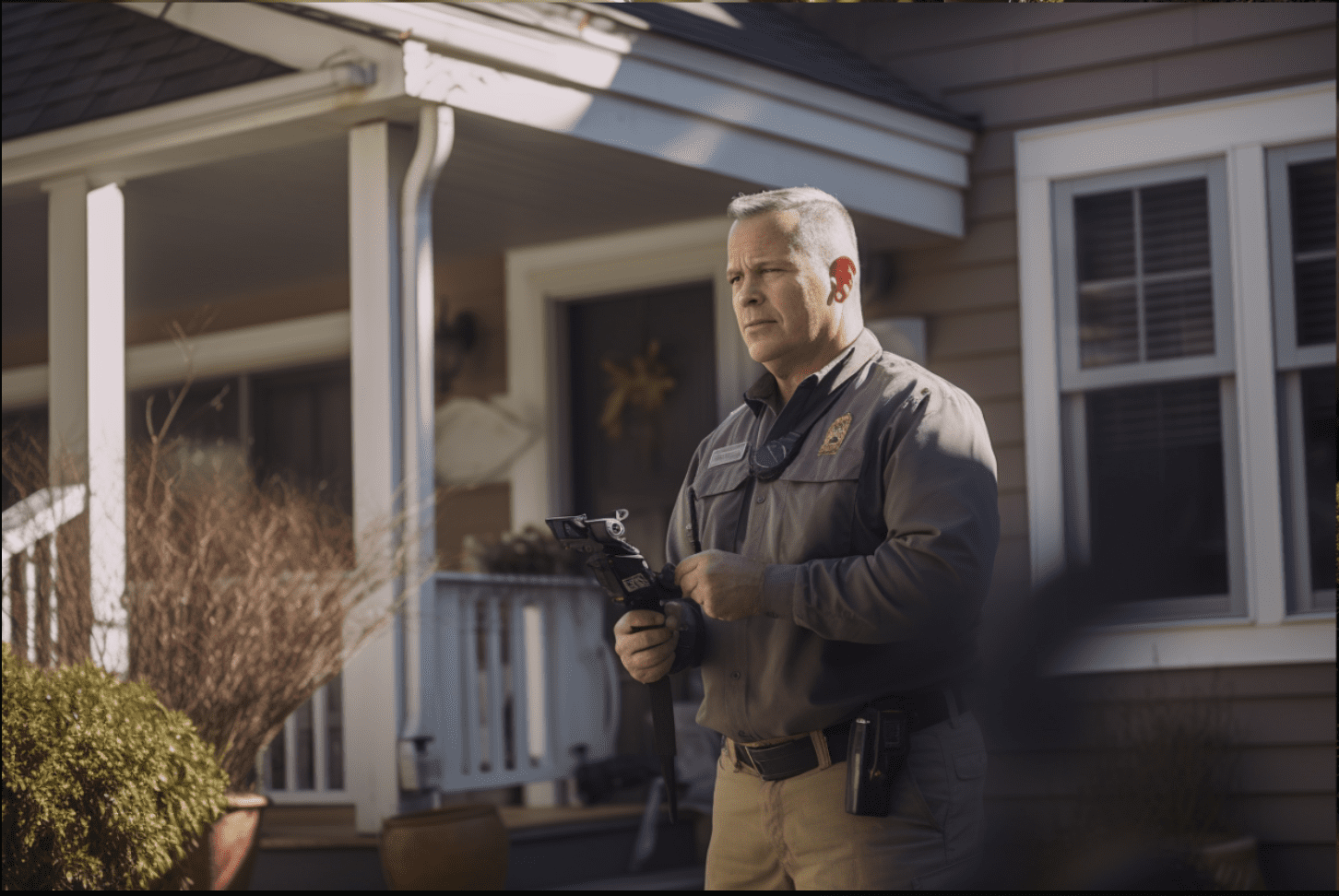

2. Property Inspection

The appraiser will visit your home to assess its condition, size, features, and any improvements. They will also consider the overall condition of your neighborhood and nearby comparable properties (comps).

3. Research and Analysis

The appraiser will gather data on recent home sales in your area, especially those that are similar to your property. They’ll use these comps to establish a baseline for your home’s value.

4. Determining Value

Using their findings, the appraiser calculates your home’s value. They take into account factors such as location, size, condition, upgrades, and any unique features.

5. Appraisal Report

Once the appraisal is complete, you will receive an appraisal report. This document provides a detailed breakdown of how the appraiser arrived at the property’s value. Review this report carefully to ensure accuracy.

What If the Appraisal Comes in Low?

Sometimes, the appraisal may come in lower than your asking price. Here’s what you can do:

Reevaluate the Price: Work with your Realtor to determine if your asking price is realistic based on the appraisal.

Negotiate with the Buyer: You and the buyer can renegotiate the price based on the appraisal results. This can involve lowering the price, asking the buyer to make up the difference, or a combination of both.

Get a Second Opinion: In some cases, it may be worth getting a second appraisal if you believe the initial one was inaccurate.

Preparing for the Appraisal

To ensure a successful appraisal, consider these tips:

Clean and Declutter: Present your home in the best possible condition by cleaning and decluttering. A neat and organized home can leave a positive impression.

Complete Repairs: Address any needed repairs before the appraisal. A well-maintained home can receive a higher valuation.

Provide Information: Be prepared to share information about recent upgrades, renovations, or unique features that could positively impact the appraisal.

Highlight Neighborhood: Share information about your neighborhood, including schools, parks, and amenities, that make your location desirable.

In Conclusion

Navigating the home appraisal process is a crucial part of selling your home in Seattle. By understanding the process and being prepared, you can increase the likelihood of a successful appraisal that supports your asking price. Remember to work closely with your Realtor, who can provide valuable guidance throughout this important step in your home selling journey. Here’s to a smooth appraisal process and a successful sale in the beautiful city of Seattle!